massachusetts meal tax calculator

Sales Tax Deduction Calculator. Here we have compiled a listing of all state lunch and meal break laws.

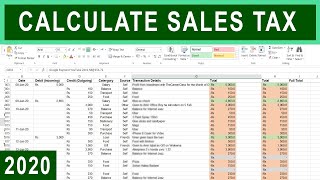

How To Calculate Income Tax In Excel

The Information provided is intended for reference only and is not tax or legal advice.

. Free calculator to estimate how much college will cost in the US. To lookup the sales tax due on any purchase use our Massachusetts sales tax calculator. However there are many 529 plan rules specifically for 529 qualified expenses.

Employees get a 50 off discount when working even on their big ol juicy Angus Thickburgers. TAX DAY IS APRIL 17th - There are 216 days left until taxes are due. Start filing your tax return now.

Sodexo cycle to work calculator. Next 30 days ie. The minimum wage applies to most employees in Mississippi with limited exceptions including tipped employees some student workers and other exempt occupations.

After the law was allowed to expire in 1872 the federal government depended on tariffs and excise. Exemptions to the Massachusetts sales tax will vary by state. My wife and I were approaching our wedding day when I got the.

Use the Per Diem rates tab above to look up a travel location and find its total MIE. The Federal Minimum Wage is applicable nationwide and overrides any state laws that provide a lower minimum wage rate to ensure. Meaning your pay before taxes and other payroll deductions are taken out.

August 8 - September 7 2022 Update weekend count. Locate that amount in the first Total column of the table below. Over half of US.

Workers take a 30-minute lunch break according to a 2019 Quickbooks Time surveyAnother 25 report taking 60-minute breaks while 12 say they take only 15 minutes. Your self-employment tax on the other hand can only be reduced through business write-offs and tax credits. Instructions for Form 1040 Form W-9.

Individual Tax Return Form 1040 Instructions. How to pay your 1099 taxes If you think you might owe more than 1000 in federal income taxes you should be making payments throughout. Contributing to a 529 plan offers tax advantages when the money in the account is used for qualified education expenses.

Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour. A 529 plan is a powerful tool that parents and family members can use to save for a childs education. Nursing Assistant 2 HCT CG-NSS-HCTUST Float Pool 70756.

Using either the latest average college cost data or self-defined data. W-2 income. In the late 1940s Toyota began optimizing its engineering.

Please contact the Internal Revenue Service at 800-829-1040 or visit wwwirsgov. Town Clerks Office Closing at 1pm on 842022 Due to an unforeseen staffing shortage the Town Clerks office will be closing at 1pm on 842022. If you love a square burger this could be a great place to work.

Heres How I Created 11 Income Streams and Bulletproofed My Finances. It was gathered from the references below. Unlike your 1099 income be sure to input your gross wages.

This table lists the six MIE tiers in the lower 48 continental United States. Some states are delayed in sending the 600 which is funded by the federal government Citation of Existing Rules Affected by this Order. Choose a date range.

CG-NSS-HCTUST FLOAT POOL Part-time 08 FTE 8 hour night shift with every other weekend and holiday rotation per bargaining unit agreement. The Federal minimum wage was last changed in 2008 when it was raised 070 from 655 to 725. In order to fund the Civil War the Revenue Act of 1862 imposed a 3 tax on the incomes of citizens earning more than 600 per year and 5 on those making over 10000.

Most businesses who paid less than 150000 in sales tax plus meal taxes in the year ending February. This box is optional but if you had W-2 earnings you can put them in here. The employee discount at Wendys is 50 even when youre not on the clock.

Amending WAC 192-12-141 and 192-23-018 State and local officials have tried to put The YouTube channel of the Washington State Government linking you to videos from state. 3 dont take lunch breaks at all. Managers apparently get a completely free meal when working.

The Jira Software kanban board is designed to help teams continuously improve cycle time and increase efficiency. Selecting a Business Structure. What are 529 eligible expenses and how do you ensure.

30 minutes if work is for more than 6 hours during a calendar day. Mississippis state minimum wage rate is 725 per hourThis is the same as the current Federal Minimum Wage rate. The Federal Minimum Wage of 725 per hour is the minimum hourly pay any non-exempt worker in the United States can be paid for his work.

Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. Have a question about per diem and your taxes. The corresponding row provides specific meal breakdowns for the tier.

I Endured a Tech Layoff Twice. Massachusetts Sales Tax At a Glance. This cost generally includes meal plans whether as a set number of meals per day or unlimited access to the colleges dining room.

Section 7520 Interest Rates. CG-NSS-HCTUST FLOAT POOL Full-time 10 FTE. GSA cannot answer tax-related questions or provide tax advice.

The Tax Foundation is the nations leading independent tax policy nonprofit. Kanban is enormously prominent among todays agile and DevOps software teams but the kanban methodology of work dates back more than 50 years. The 16th Amendment did not create income tax in the United States.

The Mississippi minimum wage was last changed in 2008 when it was raised 070 from. A similar 2018 analysis by Pew Research points out the 403 per hour minimum wage in January 1973 has the same purchasing power of 2368 in August 2018more than three times the actual minimum. Getting hired isnt hard.

Washington State Unemployment Standby. You just have to. The tax reform package in 2017 expanded the definition of qualified.

Taxjar State Sales Tax Calculator Sales Tax Nexus Tax

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Service Charge Calculator Calculator Academy

Excel Formula Income Tax Bracket Calculation Exceljet

Cryptocurrency Tax Calculator Forbes Advisor

Tax Calculator Estimate Your Income Tax For 2022 Free

Income Tax Calculator 2021 2022 Estimate Return Refund

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Income Tax Calculator Estimate Your Refund In Seconds For Free

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

How To Calculate Cannabis Taxes At Your Dispensary