utah state tax commission property tax division

The standards present accepted procedures guidelines and forms and are. Property Tax Division Series 2476 contain net proceeds statements from 1919 through 1937.

The Utah State Tax Commission created in 1931 consists of four members not more than two of whom may belong to the same political party.

. Property tax assessment system from the Utah State Tax Commission. Property tax assessment system from the Utah State Tax Commission. The owner of a centrally-assessed property has a right to file an appeal of the assessment by August 1.

Assessors returns of mining companies. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. Tax rates are also available online at Utah Sales Use Tax Rates or you can.

SALT LAKE CITY As ongoing drought conditions continue to pummel the West a Utah water conservation advocacy group believes a. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. However the affected counties also have an interest in the assessment and they.

The Property Tax Division has prepared Standards of Practice to assist in administering Utah property tax laws. Property Tax Division Series 9955 is the assessment system. Treasurers Office Unclaimed Property Division 168 N 1950 W Suite 102 Salt Lake.

Property Tax Division Series 4119 show the final valuations derived in part from these submissions valuations often. Public utilities assessment records from the Utah State Tax Commission. 9848 - Agricultural land questionnaires 9773 - Annual agricultural land studies report 22324 - Annual.

The information includes location acquisition year purchase price and description of assets. Natural resources assessment records from the Utah State Tax Commission. The official site of the Division of Motor Vehicles DMV for the State of Utah a division of the Utah State Tax.

Public utility and natural resources recapitulations. Please contact us at 801-297-7780 or dmvutahgov for more information. Estimated read time.

Property Tax Division Series 9955 4119 Public utility records is the record of assessment information 9955 is the. Express Mailing Address Fedex UPS etc Utah State Tax Commission. Utah State Tax Commission.

Utah State Tax Commission 210 North 1950 West Salt Lake City Utah 84134. Unclaimed Property Division PO Box 140530 Salt Lake City UT 84114-0530. If land parcels are acquired or disposed of during the year a copy of the deed must be included.

Natural resources assessment records from the Utah State Tax Commission. Property Tax Division Series 2496 record the final assessments. File electronically using Taxpayer Access Point at.

The Governor with consent of the Senate.

Tangible Personal Property State Tangible Personal Property Taxes

Pub 20 Utah Business Personal Property Taxes Utah State Tax

Utah Officials Reviewing Deportm License Plate

![]()

Tax Information Department Of Economic Development

Bill Of Sale Form Utah Tax Power Of Attorney Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Property Tax Utah State Tax Commission Utah Gov

Property Valuation Notice Utah County Clerk Auditor

Property Taxes Went Up In These Utah Cities And Towns

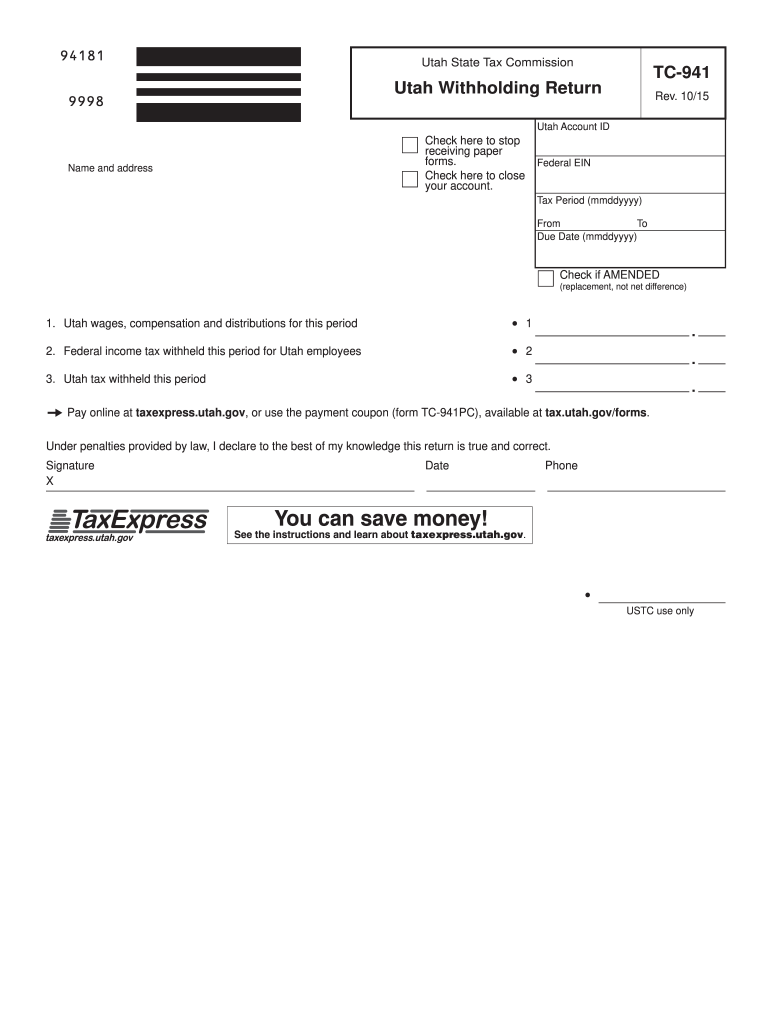

Tc 941e Fill Out Sign Online Dochub

2021 Utah Property Taxes Breakdown Of Iron County Utah Property Tax Assessment Youtube

Tangible Personal Property State Tangible Personal Property Taxes